A condensed update of the current market and supply chain condition of hydrocolloids with a closer look at Carrageenan. This follows our update last August 2022

PHILIPPINE WEATHER:

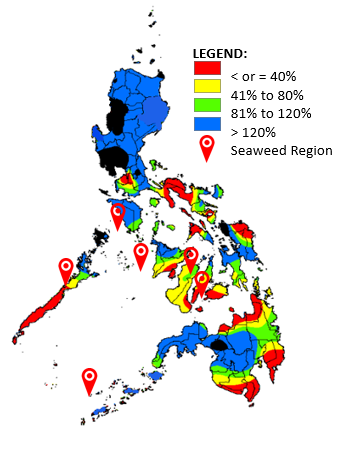

- The weather systems that will likely affect the whole country are the southwest monsoon, intertropical convergence zone (ITCZ), low-pressure areas (LPAs), tropical cyclones (TC), and localized thunderstorms.

- 3 Tropical Cyclones (2 Severe Tropical Storms and 1 tropical Depression) hit the Philippine Area of Responsibility (PAR) for the month of August. STS “Florita” – international name Ma-on (August 21 – 23), TD “Gardo” (August 30 – September 01), and STS “Henry” – international name Hinnamnor (August 31 – September 3). STS ‘Florita” traversed the landmass of Northern Luzon and in some areas in Central Luzon. TD “Gardo” did not directly impact the whole country and was merged with the circulation of STS “Henry”. Likewise, STS “Henry” did not landfall anywhere in the country.

- Seaweeds Farms located in South Luzon, Palawan, and Mindanao are not affected by the typhoon from last month but somehow affect the movement of marine transits due to moderate to rough seas caused by the tropical storms.

- Tropical Storm “Inday” (“MUIFA” – international name) may bring moderate to rough seas over the seaboards of Extreme Northern Luzon beginning on Saturday (September 10, 2022). Tropical Storm Inday will not landfall anywhere in the country.

- The whole country will generally experience partly cloudy to cloudy skies with isolated rain showers and thunderstorms. Moderate to rough seas will prevail over the western seaboards of Luzon while the rest of the archipelago will have slight to moderate seas.

- La Nina increases the likelihood of having above-normal rainfall conditions that could lead to potential adverse impacts (such as heavy rainfall, floods, and landslides) over highly vulnerable areas.

SEPTEMBER 2022 RAINFALL FORECAST

LOGISTICS:

International:

- The International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA) began talks on May 10 in San Francisco. They released a joint statement on July 26 saying they had reached a tentative agreement on the health benefits of the dockworkers. That still left the two sides to find consensus on major issues including wages and automation. Despite the unfinished negotiation, service levels at the West Coast ports remain steady. (Source: Wall Street Journal)

- CNN said in an article that the looming possibility of a strike by unions representing more than 90,000 workers at the US nation’s freight railroads has businesses nationwide worried. The union is poised to go on a strike on September 16, according to the Bureau of Transportation Statistics this move could bring 30% of the nation’s freight to a grinding halt. The unions and the National Railway Labor Conference, representing management at the negotiating table, met with federal mediators and US Labor Secretary Martin Walsh on Wednesday to see if they could move closer to an agreement. The unions said there was no progress.

- More than 560 dockworkers at the Port of Liverpool, one of Britain’s largest container docks, will go on strike from Sept. 19 to Oct. 3 over pay, the Unite union said on Friday, adding to a summer of industrial unrest caused by soaring inflation. The workers, comprising port operatives and maintenance engineers, are striking over a 7% pay offer they say amounts to an effective “pay cut” with inflation reaching double digits. (Source: Reuters). Importers should be advised that supply chain disruptions are likely; and that additional fees for diversion, storage, and inland haulage will be a possibility as well if cargo has to be redirected.

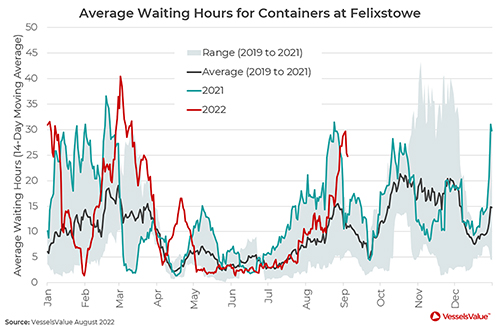

- Latest data from VesselsValue highlighted that following the late-August walkout due to pay disputes, some container operators were unable to make alternative voyage plans, leading wait times at Felixstowe to climb towards year highs.

Local:

- Philippines’ Local sea freight is slowly moving due to the current weather, especially for the small boats used as seaweed carriers locally. The wind from the southwest monsoon creates strong waves resulting in small boats postponing their set sail causing delays in local shipments.

SEAWEEDS AND CARRAGEENAN:

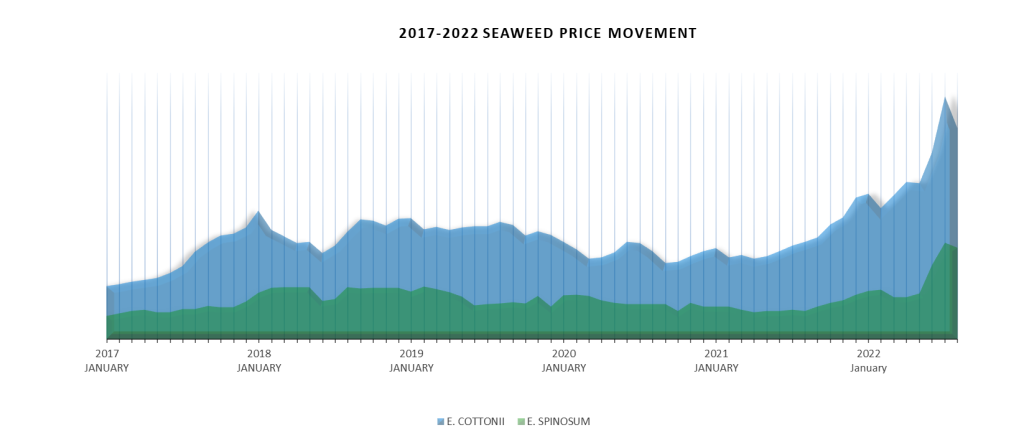

- According to the Bureau of Fisheries and Aquatic Resources, the supply of E. cottonii in the Philippines declined by 12.5% compared to last year. With the ensuing harvest season of seaweeds in Indonesia, the demand is gradually stabilizing leading to slight ease in price. The value of seaweeds in the Philippines is directly proportional to the value of seaweeds in Indonesia.

- The supply of E. spinosum for this month exceeded the current demand resulting in a decrease in price. Also, the price of E. spinosum is directly proportional to the price of E. cottonii.

OTHER HYDROCOLLOIDS:

- Konjac Gum – The supply of konjac gum remains stable while the price slightly increases in the month of August as the harvest season is coming. China, as the key supplier of Konjac Gum, konjac harvest season is every fourth quarter of the year.

- Locust Bean Gum – Harvest season of LBG crops starts from July to October which results in a price to slightly soften. On the other hand, the supply of new crops from Morocco is forecasted to be insufficient in the next few months due to the drought that the winter season will bring from November to January next year.

- Tara Gum – The peak of the harvest season of tara crops is in the month of August and usually lasts until November to December. The price remains stable.

- Monoglyceride –The supply stabilized after Indonesia lifted the export ban on Palm Oil which results in a gradual decrease in market price.

- Xanthan Gum – The price of Xanthan Gum remains on an uptrend due to the current supply. China’s “Zero Dynamic Policy” (Covid Restriction) and “China Power Rationing” affects the production capacity of Xanthan Suppliers resulting in undersupply and serious backlogs of order.

- Dextrose Monohydrate and Maltodextrin –The prices are still high due to the gradual increase in corn price. Corn Harvest in China is every fourth quarter of the year, starting from late September and due to this price may slightly soften.

- Guar Gum – Sowing is far more extensive this year than last year due to the water crisis in Rajasthan and Haryana, India. It is expected that the Guar market won’t run up anytime soon. Crop estimates will not be available for at least a month from now.

RECOMMENDATION:

- As the peak season in the shipping industry arises, we encourage our clients to study in detail your supply and demand until the end of the year. Purchase planning should give great consideration to projected increasing raw materials and shipping costs, and continued uncertainty on delivery lead times.