A condensed update of the current market and supply chain condition of hydrocolloids with a closer look at Carrageenan. This follows our update last September 2022

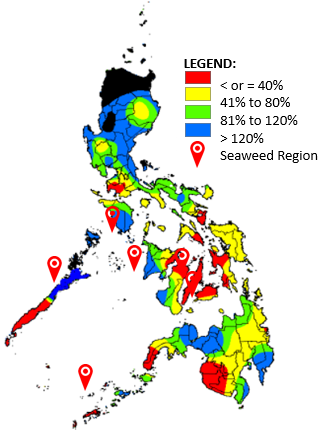

PHILIPPINE WEATHER:

- The weather systems that will likely affect the whole country are the southwest monsoon, northeasterly wind flow, easterlies, intertropical convergence zone (ITCZ), frontal system, low-pressure area (LPA), and localized thunderstorms.

- Generally, good weather conditions will be experienced in most parts of the country with some chances of isolated rain showers or thunderstorms except in Isabela, Aurora, Quezon, and Bicol Region where cloudy skies with rain showers and thunderstorms are expected due to easterlies.

- Slight to moderate seas will be experienced over the whole archipelago.

- As of October 13, 2022, Typhoon Jebi (Local Name – Typhoon Maymay) was spotted in the northeast of the Philippines and weakens into a low-pressure area. Despite this, the surge of northeasterly surface wind flow still occurs resulting in rough to very rough seas (2.8 to 5.5 m) that will prevail over the seaboards of Northern and Central Luzon and the eastern seaboard of Southern Luzon.

- La Niña re-strengthened and is forecasted to continue until DJF 2022 – 2023 (~60%) with ENSO neutral condition thereafter. This increases the likelihood of having above-normal rainfall conditions that could lead to potential adverse impacts (such as heavy rainfall, floods, and landslides) over highly vulnerable areas

OCTOBER 2022 RAINFALL FORECAST

Astronomical Administration (PAGASA)

LOGISTICS:

International:

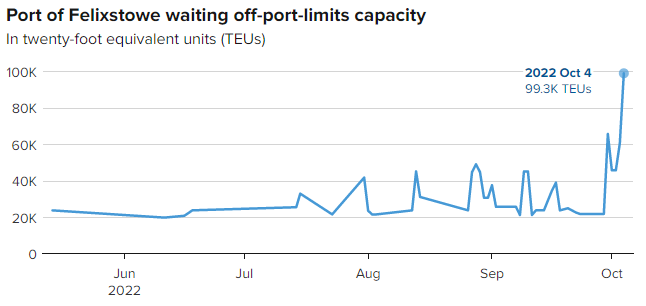

- The prior strike in Felixtowe that ended last October 5, resulted in port congestion rising three times higher than usual reaching more than 99,000 TEUs (Twenty-foot equivalent unit Containers), according to the data of MarineTraffic. In Addition, the first strike in Liverpool started last September 19 and ended last October 3. Currently, dockworkers in Liverpool are planning to start a second strike from October 11 to October 17. The Unite union told CNBC they will continue to hold these strikes until their pay matches the inflation. While the situation in Felixstowe worsens, other ports are being disrupted as a result of the prior strikes in Felixstowe and Liverpool. (Source: CNBC)

Source: MarineTraffic

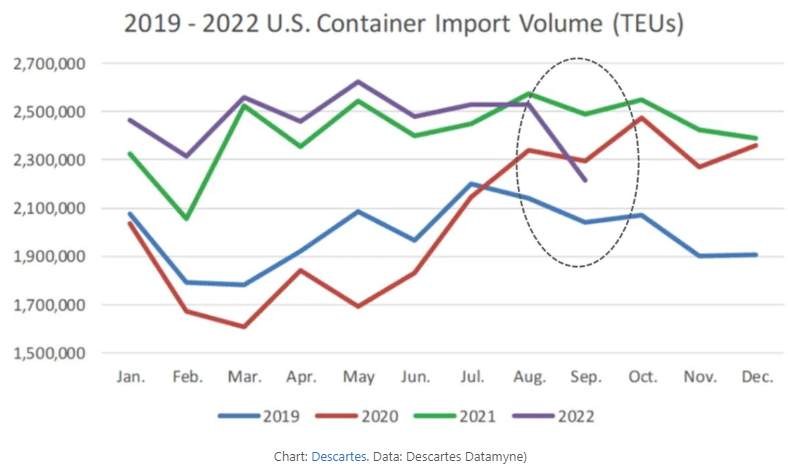

- According to Descartes’ reports, which aggregates U.S. Customs data, inbound volumes to all U.S. ports totaled 2,215,731 twenty-foot equivalent units in September. That’s down 11% year on year and 12.4% from August. The report shows that a slowing economy, retailers reducing purchases, inflation, and high fuel costs are finally making an impact on U.S. container imports. However, the decrease in September import volumes did not have a measurable impact on port delays, especially for East and Gulf Coast ports, which continues to point to congested and challenging global supply chain performance for the rest of 2022. (Source: www.freightwaves.com)

- On September 16th, representatives from US Customs and Border Protection (CBP) and Brazil’s Customs Authority signed an Authorized Economic Operator (AEO) Mutual Recognition Arrangement (MRA) to build on other agreements between the two countries and to coordinate each nation’s supply chain security and ongoing efforts to combat trade offenses. By signing off on this arrangement, Brazilian officials acknowledge and confirm that the security requirements and/or standards of its foreign industry partnership program and its verification procedures are the same or align with the Customs Trade Partnership Against Terrorism (CTPAT) program. (Source: www.shapiro.com)

- A U.S. union of railroad track maintenance workers (Brotherhood of Maintenance of Way Employes Division – BMWED) has rejected a tentative agreement with the nation’s freight carriers, renewing the threat that there could be a strike that shuts down this vital link in the nation’s already struggling supply chain. The Brotherhood of Maintenance of Way union agreed to hold off any potential strike until after Congress reconvenes in mid-November to allow time for further negotiations. (Source: CNN)

Local:

- Despite their recent high utilization, Manila ports are not congested, according to Sarmiento (Department of Transportation (DOTr) Undersecretary for Maritime) during a press conference for the 2022 National Maritime Week Celebration on September 19 at the Philippine Ports Authority (PPA) headquarters. In a separate statement, PPA said “all aspects of operations at the Manila Ports are under an optimum condition with an average berth occupancy rate for the North Port [Manila North Harbor domestic terminal], South Harbor, and the Manila International Container Terminal at 43%.” (Source: www.portcall.com)

SEAWEEDS AND CARRAGEENAN:

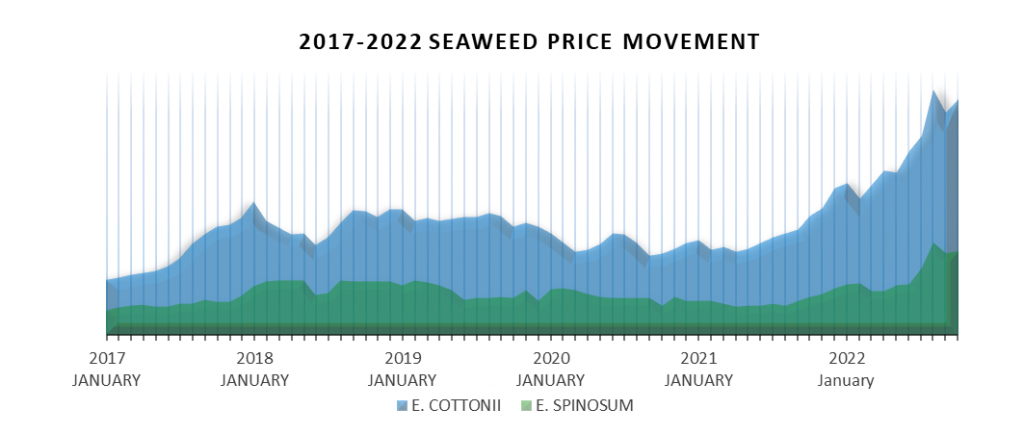

- E. cottonii’s price, to a certain extent, increases due to the effect of the past typhoons in the past weeks, particularly in the area of Luzon. It is forecasted that the price will gradually increase up until January 2023 since most companies in the industry store raw materials in the preparation for the 2023 Chinese New Year.

- The price of E. spinosum slightly increases due to the increase in demand. It is forecasted that the price will be stable until the end of the year

- 4 typhoons hit the Philippines’ Area of Responsibility last month (September 2022), which affect the logistic flow of seaweed distribution resulting in a 2-3 weeks delivery delay.

OTHER HYDROCOLLOIDS:

- Konjac Gum – China’s konjac harvest season is every fourth quarter of the year. The harvest season signifies a guarantee of the more consistent quality of Konjac raw materials. It also indicates stable supply and price in the next few months.

- Locust Bean Gum – first seeds from kibblers are already out since mid-September and will be turned into LBG this month. The new crops in Morrocco are already available but the yield is forecasted to be insufficient in the next few months due to the drought that the winter season will bring from November to January next year.

- Tara Gum – Currently, the Tara Gum price is stable as the peak harvest already takes place last August and usually lasts until November to December.

- Monoglyceride –The price gradually decreases since Indonesia is back serving the international market. However, palm oil output in Malaysia, the world’s second-largest producer, is forecast to decline, or at best remain unchanged, from last year, according to planters and analysts. The decline in the output of Malaysia is due to a lack of skilled harvesters, so companies cannot fully capitalize on the peak harvest season that spans from August to November, forgoing a boost of growth from recent rains.

- Xanthan Gum – The demand for Xanthan gum in the past months has greatly increased, mainly in Oil-grade xanthan gum, due to the further rise of crude oil price results from the Russia and Ukraine situation. As a consequence of the increasing demand in the oil industry, the cost of Food Grade Xanthan remains on an uptrend.

- Dextrose Monohydrate and Maltodextrin –The prices are still high due to the gradual increase in corn price and weak demand in the past months. Corn Harvest in China is every fourth quarter of the year, starting from late September and due to this prices may slightly soften.

- Guar Gum – Sowing is far more extensive this year than last year due to the water crisis in Rajasthan and Haryana, India resulting in short supply.

RECOMMENDATION:

- We suggest planning your order to secure your requirements and keep your communication with our Sales Team to ensure the right quantity of ingredient solutions for your products.