A condensed update of the current market and supply chain condition of hydrocolloids with a closer look at Carrageenan. This follows our update last November 2022

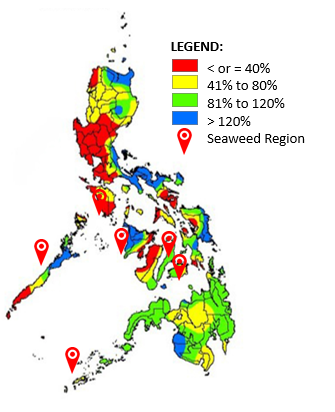

PHILIPPINE WEATHER:

- Tropical Storm ROSAL (International Name: PAKHAR) has already entered the Philippine area of responsibility and has brought heavy rains and rough seas in the second to the third week of December. Another typhoon is possible to enter PAR until the end of December 2022.

- La Niña is expected to persist until March 2023, afterwards, El Niño–Southern Oscillation (ENSO)-neutral will presume. This increases the likelihood of having above-normal rainfall conditions that could lead to potential adverse impacts (heavy rainfall, floods, and landslides) over highly vulnerable areas. Seaweed farms in the Bicol Region and Palawan area will be slightly affected by rough seas caused by La Niña.

- The quality of seaweeds is affected by inclement weather (strong rains and winds that can cause rough seas) conditions forcing farmers to harvest the crops untimely resulting in low-yield finished goods.

DECEMBER 2022 RAINFALL FORECAST

Astronomical Administration (PAGASA)

LOGISTICS:

International:

- On the anticipated national rail strike in America, the House passed legislation last November 30, 2022, that would force a tentative rail labor agreement and thwart a national strike in the United States. The House voted 290 to 137 to pass the legislation, which approves new contracts providing railroad workers with 24% pay increases over five years from 2020 through 2024, immediate payouts averaging $11,000 upon ratification, and an extra paid day off. Railway companies and labor unions reach an agreement last December 2, 2022, to call off the anticipated strike that risked major disruptions.

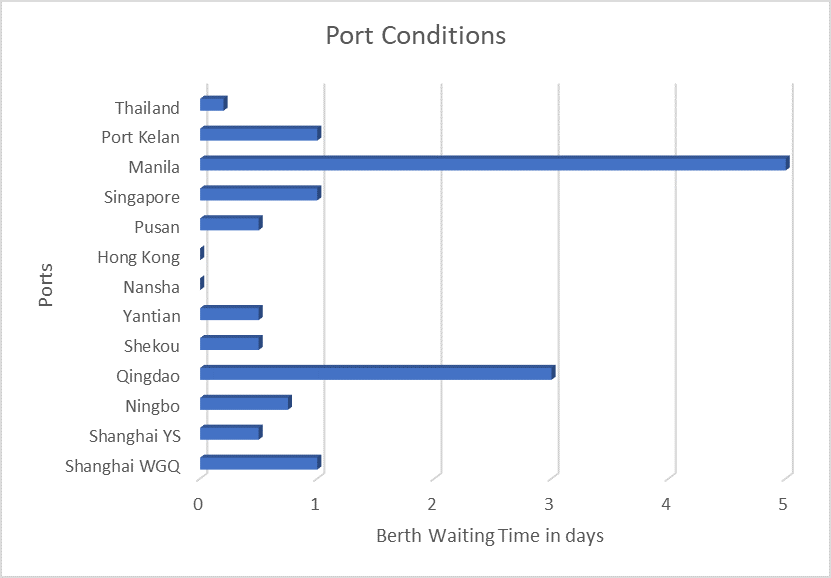

- According to Logwin Air + Ocean Logistics as of December 2022, ports in Manila reached an average of 5 days of berth waiting time due to the vessel bunching arrival. Due to the congestion in the ports of Manila, shipments for exports are delayed by around 1 to 2 days according to W Hydrocolloids’ logistics department.

- One of the busiest ports in China (the port of Quingdao) remains congested with an average of 3 days of berth waiting time due to bad weather resulting in the long closure of the said port. However, according to Maritime Intelligence, China’s transport ministry removed the mandatory COVID test for port workers, except for those on-duty workers that are exposed to high-risk infection. The removal of COVID test for the port workers increases their port’s manpower which may help control port congestion.

Source: Logwin Air + Ocean Logistics

- Major travel disruption is expected in the UK as the strike of nearly 40,000 rail workers begins. Rail, Maritime, and Transport Union (RMT) announced further industrial action at Network Rail and 14 other train operators on 13 to 14 and 16 to 17 December as well as 3 to 4 and 6 to 7 January next year.

Local:

- The Metropolitan Manila Development Authority (MMDA) warned Monday (December 12, 2022) that road congestion is expected to spike by 10 percent in the coming days since the major population is preparing for Holiday Season. (Source: Philippines Inquirer)

- The Philippine Energy Department’s latest monitoring shows gasoline prices have so far risen by ₱13.25 per liter this year in comparison with last year’s price, ₱24.60 for diesel, and ₱19.15 for kerosene. The local prices of petrol slightly affect the price of seaweed mainly in transportation cost which is added to its final price output.

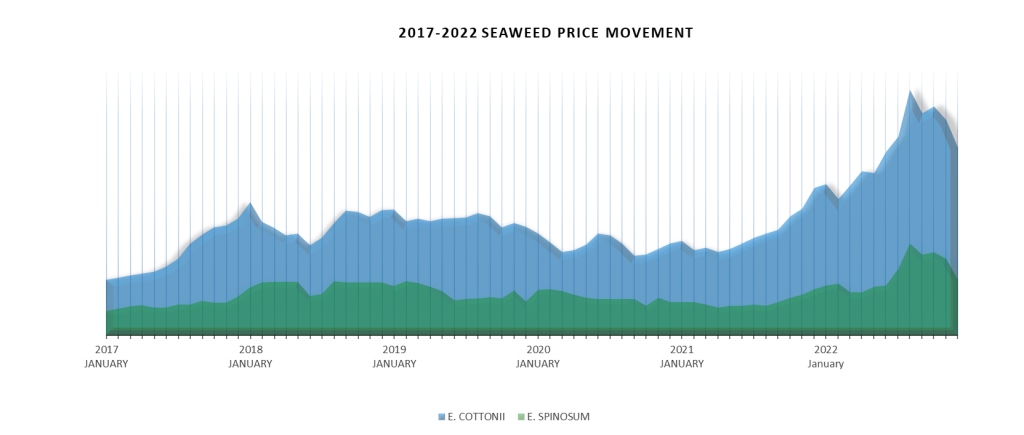

SEAWEEDS AND CARRAGEENAN:

- E. cottonii supply and price are currently stable due to restrained demand. On the other hand, the price is forecasted to gradually increase due to the recent earthquake that hit Indonesia (one of the main players in the seaweed market). It is estimated that the price will increase by around 10%-15% until February 2023.

- E. spinosum is currently oversupplied and the price will be stable in the next few months. The quality remains normal.

- Seaweed delivery time remains unpredictable due to weather conditions and traffic jams.

OTHER HYDROCOLLOIDS:

- Konjac Gum – The drought in China from last September 2022 still affects the konjac price to go up. There are delays in harvest and an insufficient supply of Konjac finished goods brought on by the drought in China.

- Locust Bean Gum – There’s no significant movement on the LBG Market. The supply from Morocco is still insufficient due to the current drought brought on by the winter season. Price slightly increases due to the latter conflict.

- Tara Gum – The crops of Tara raw materials greatly increase in comparison to the previous years. The price remains stable as the harvest season will continue until November 2022 to December 2022.

- Monoglyceride – Southeast Asia is experiencing a rare third consecutive La Nina weather pattern, resulting in a production output decline, especially in Palm oil production (the main raw material in Monodi production). As of now, the price remains stable but it is forecasted that in the next few months price will increase further due to the excessive rain caused by La Nina and the rising demand in the biofuel and food industry.

- Xanthan Gum – The supply of Xanthan gum remains short due to the significant impact of the energy crisis in China last 2021 that result in reduced production capacity. According to suppliers, severe order backlogs occurred in the past months, and forecasted that it will take until next year to clear.

- Dextrose Monohydrate and Maltodextrin – According to suppliers, the supply is sufficient as the demand remains low due to the Chinese government’s COVID-19 restrictions. On the other hand, occurring price fluctuation is driven by currency revaluation and devaluation.

- Guar Gum – the new crops have arrived in the market in good quantity. Currently, the demand for guar gum remains elevated driving the price to increase.

- The easing of COVID restrictions in China is welcomed by manufacturing companies with caution. According to Nikkei Asia, manufacturing companies in China are struggling to prepare for a virus infection surge that could further slow production as China’s zero COVID policy eases.

RECOMMENDATION:

- Planning your requirement a quarter ahead is highly recommended with caution to only cover your firm’s needs to assist in reaching a more sustainable balance between the supply and demand of raw materials.

- Raw material prices, especially seaweed, are expected to increase due to the upcoming Chinese New Year which starts on January 22, 2023. Be reminded that this is a week-long holiday in China that generally affects the movement of seaweed and carrageenan prices just like in the past. Please secure your orders accordingly.