A condensed update of the current market and supply chain condition of hydrocolloids with a closer look at Carrageenan. This follows our update last May 2023.

PHILIPPINE WEATHER:

- According to Philippine Atmospheric Geophysical and Astronomical Administration (PAGASA), the western sections of Luzon and Visayas will experience cloudiness with rain showers and thunderstorms due to the prevailing southwest monsoon while the rest of the country will likewise be cloudy with rain showers and thunderstorms due to the expected approach of a low-pressure area.

- Low pressure has formed in the last week of June 2023 around the eastern part of the Philippine sea. This will continuously emerge over the northern part of the Philippines with a low to moderate probability of development to a tropical cyclone.

- Generally, cooler to warmer surface temperatures will be experienced over Luzon and Mindanao while Visayas will experience slightly below to slightly warmer surface temperatures. Warmer and humid weather conditions are expected to be experienced.

- According to the PAGASA weather forecast, the transition to El Niño is favored in the next couple of months, with a higher chance of El Niño persisting up to the first quarter of 2024.

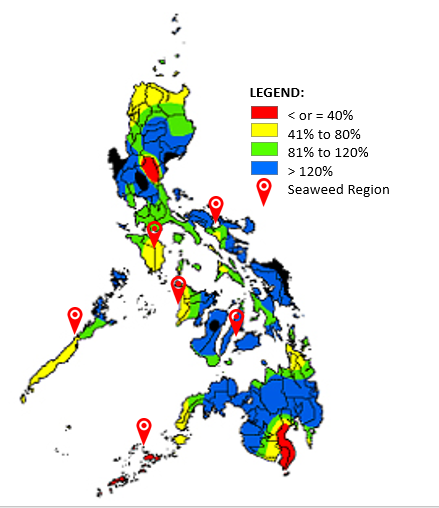

JUNE 2023 RAINFALL FORECAST

Astronomical Administration (PAGASA)

LOGISTICS:

International:

- The International Workers Union (ILWU) and port operators have reached an agreement after a nearly year-long labor dispute, thus shippers’ doubt about possible strikes has been alleviated.

- Ports in the Asia-Pacific to most regions in the world, as well as intra-Asia ports are currently stable with no major disruptions. On the other hand, ports in North America especially in East Coast ports, Savannah, and Houston ports are experiencing 0-1 day shipment delays due to the current labor shortage.

- Ports in Latin America are experiencing 1-3 days shipment delays due to increasing market demand, especially in the port of Parangua, Manzanillo – Mexico, and San Antonio.

- The Panama Canal is restricting large ships because of drought. Starting June 25, 2023, container ships in the Panama Canal will be limited to a depth of 43.5 feet or 13.3 meters. The new restrictions will require ships to either carry less cargo or shed other weight to float higher in the canal. But the lighter loads may lead to shipping delays. Capacity limits and surcharges are already increasing for vessels going through the canal. The trade route that is most affected is the Northern Europe to South American West Coast corridor.

- European hub terminals are operating smoothly with stable productivity and density. It is forecasted that stable service will prevail in the major Key ports of Europe, even with potential labor reductions during the holiday season.

Local:

- According to Philippine News Agency (PNA), The Philippine Ports Authority (PPA) began preparing its ports and other facilities nationwide for the rainy season enhanced by the southwest monsoon or ‘habagat.’ PPA works with the Philippine Coast Guard and local government units to ensure the safety of passengers in ports and to provide emergency transportation if necessary.

- Higher NLEX toll rates kick in from June 15, 2023. New toll rates will be higher by P7 to P98 than previous, depending on vehicle type and distance traveled.

SEAWEEDS AND CARRAGEENAN:

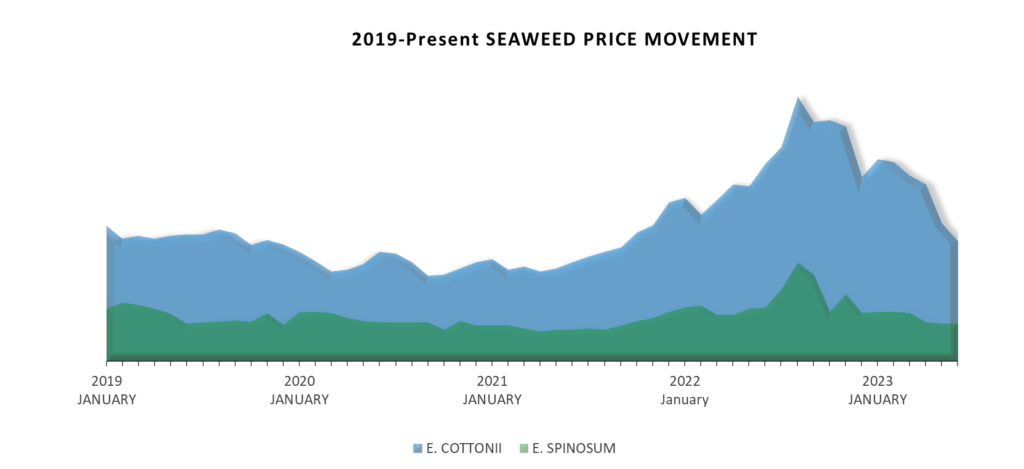

- Currently, the E. cottonii market is still showing signs of declining prices due to the dropping demand for seaweed market. On the other hand, it is forecasted that the price may slightly increase by July due to the possibility that demand may increase and will be stable for the next few months. The quality of E. cottonii remains stable due to the current weather system which allows seaweed farmers to dry their harvested seaweed properly.

- The price of E. spinosum is forecasted to continue to drop gradually due to the current high supply and low demand. On the other hand, despite the announcement of the Philippine Coast Guard of oil spill removal completion, the repercussions still affect the seaweed industry, especially the E. spinosum considering that E. spinosum dominates the seaweed farms in the Mindoro area. The quality of E. spinosum planted in Mindoro shows signs of deterioration due to the spill. According to suppliers, seaweed farmers were forced to harvest their crops before the oil spill reached their farming areas, which resulted in underdeveloped seaweed output.

OTHER HYDROCOLLOIDS:

- Konjac Gum – The price of Konjac Gum retains its high price due to the weakening of US Dollars against the Chinese Yuan. The severe drought that occurred in the area of China where Konjac gums are grown is still affecting the supply resulting in a delayed harvest and increasing price.

- Locust Bean Gum – The price of LBG is currently stable at present since the on-hand LBG supply of kibblers and stockers remains firm. It is forecasted that the price will remain stable in the next few months as the harvesting season will start within the months of July to September.

- Tara Gum – The price of Tara remains stable as the supply remains high from the harvest season that started last August and ended in December. In addition, the price of Tara is highly correlated to the price of LBG.

- Monoglyceride – Palm Oil (the main raw material in monoglyceride production) is forecasted to be stable resulting in the price of monoglyceride remaining stable as well this year despite volatility last year.

- Xanthan Gum – The demand for Xanthan Gum remains high in the current quarter of 2023 despite the short supply in the market driving the price to increase. The price fluctuations of corn and coal also have a certain impact on the price knowing that they account for 70% of the production cost of Xanthan Gum.

- Dextrose Monohydrate and Maltodextrin – Prices of Dextrose Monohydrate and Maltodextrin remain volatile due to the weakening of US Dollars against the Chinese Yuan. According to suppliers, it is forecasted that the price of dextrose will gradually decrease as the producers increase their supply capacity in the market while maltodextrin’s price is forecasted to increase due to a recent explosion in one of the largest factories in China.

- Guar Gum – The price of Guar Gum has gone up by 5% despite the price softening last month due to excessive rains in key guar-growing areas. The demand is currently stable due to the gradually decreases of demand in the Oil industry.