A condensed update of the current market and supply chain condition of hydrocolloids with a closer look at Carrageenan. This follows our update last March 2023.

PHILIPPINE WEATHER:

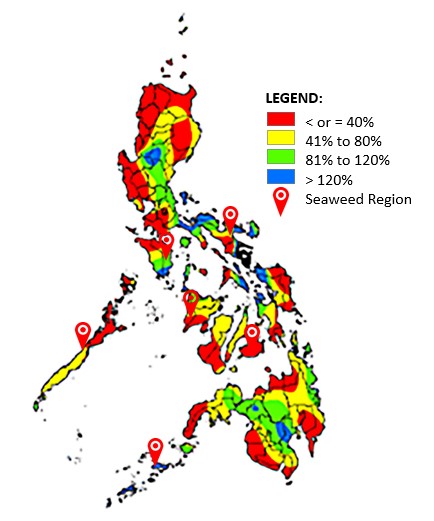

- Last April 11, 2023, the first tropical cyclone of the Philippines for 2023 named “Amang” entered the eastern seaboard of the Philippine Area of responsibility. Typhoon Amang crossed the area of the Bicol Region, Camarines Norte, and Quezon Provinces.

- Typhoon Amang will slightly affect the seaweed farms located mostly in Bicol Region due to the rough seas that the typhoon will cause. As PAGASA announced last April 13, the typhoon dissipated within 24 hours and better local weather prevailed since then.

- As forecasted by PAGASA, there will be no potential threat of tropical cyclones expected to enter the PAR until the end of April 2023. Better weather conditions will prevail in the entire archipelago for seaweed farming in the remaining days of April 2023.

- The Philippines is currently experiencing La Niña weather, however, the PAGASA warning system is now raised to El Nino watch in preparation for a dry season in the coming months. During the transition, better weather conditions will prevail in the entire archipelago for seaweed farming.

APRIL 2023 RAINFALL FORECAST

Astronomical Administration (PAGASA)

LOGISTICS:

International:

- According to Maersk, port disruptions occurred in the first week of April 2023 in the Port of Los Angeles and Port of Long Beach due to union action relating to the ongoing negotiations between the Pacific Maritime Association (PMA) and the International Longshore and Warehouse Union (ILWU). Dockworkers in key positions failed to show up for shifts at the nation’s busiest container port complex on the evening of April 6 until the following day, resulting in a 24-hr port operation shutdown. Currently, the said ports are operating normally but prior disruption raised fears over US Imports resulting in most importers shipping via Atlantic and Gulf ports.

- Asia and Pacific to North America ports are currently stable due to softening demand.

- Asia and Pacific to Latin America’s market shipping rates stabilized on the low end and are forecasted to increase next month as the market will try to implement a general rate increase this April 2023. Port utilization shows 75%-85% on the East Coast and 80%-90% on Mexico and West Coast.

- All schedules and ports in Intra-Asia have been running smoothly since February. Shipping rates continue to decrease at a slow pace.

- Massive nationwide strike hits France over pension reform. Nationwide demonstrations take place against French President Emmanuel Macron’s plan to push the retirement age from 62 to 64. Nine strikes were already held since last month and possible strikes may still occur on April 20 and April 28, 2023, according to Connexion Publishing.

Local:

- The Department of Public Works and Highways (DPWH) will be conducting road reblocking and rehabilitation on Blumentritt Street in Manila from April 14 to May 12, 2023. There will be a partial road closure to give way to that said rehabilitation efforts. Motorists are advised of traffic slowdown in the affected areas and to use possible alternate routes. Moderate to heavy traffic congestion is expected to occur in the area causing possible delays in our local deliveries.

- The Trusted Operator Program – Container Registry and Monitoring System (TOP-CRMS) is the Philippine Port Authority’s proposed electronic system to register and monitor the movement of foreign containers entering and leaving PPA ports. Under PPA Administrative Order (AO) No. 04-2021, foreign containers are required to register with TOP-CRMS and secure a container insurance policy. On the other hand, there is strong opposition to the implementation of TOP-CRMS. Currently, the implementation of TOP-CRMS is on-hold and on senate hearing amid fears of additional costs that will occur.

SEAWEEDS AND CARRAGEENAN:

- According to the Bureau of Fisheries and Aquatic Resources (BFAR) as of April 13, 2023, seaweed farming/harvesting is banned in the area of Antique due to the polycyclic aromatic hydrocarbons (PAH), a toxic contaminant from the Mindoro oil spill last month, found in the samples collected from the area. The ban will remain until further evaluation shows it is safe for public consumption.

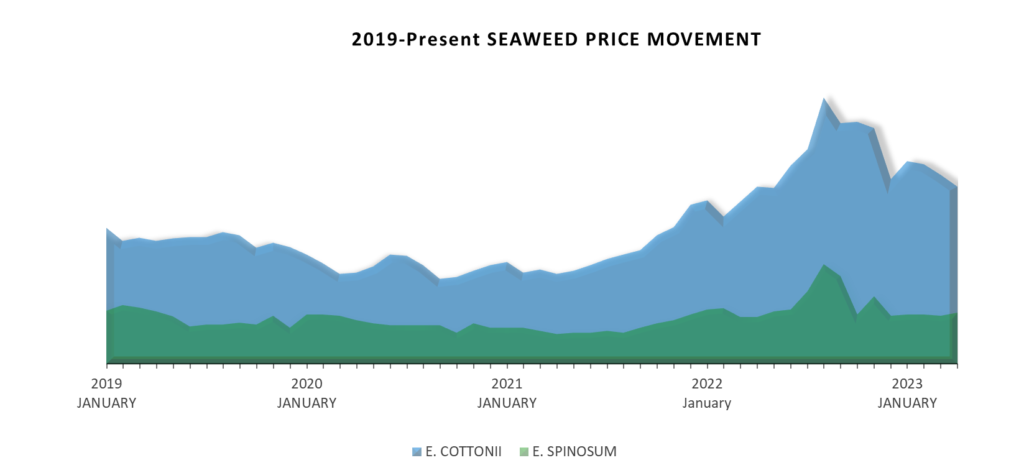

- The price and supply of E. cottonii remain stable for now, still, the forecast implies that the price will gradually increase in the coming months based on historical data on the previous years as typhoon seasons, which usually occur in the months of June to September, are still present despite El Niño’s occurrence.

- The price of E. spinosum is forecasted to decrease gradually until the end of next month due to the current high supply and low demand. The oil spill already reached the farms of E. spinosum located in Mindoro, but due to the high market inventory, the current seaweed market is not yet affected for now.

OTHER HYDROCOLLOIDS:

- Konjac Gum – The price of Konjac Gum retains its high price due to the weakening of US Dollars against the Chinese Yuan. The severe drought that occurred in the area of China where Konjac gums are grown is still affecting the supply resulting in a delayed harvest.

- Locust Bean Gum – The price of LBG declined in the last few months and is forecasted to remain stable in the next months.

- Tara Gum – The price of Tara remains stable as the supply remains high from the harvest season that started last August and ended in December. In addition, the price of Tara is highly correlated to the price of LBG.

- Monoglyceride – Palm Oil (the main raw material in monoglyceride production) is forecasted to be stable resulting in the price of monoglyceride remaining stable as well this year despite volatility last year.

- Xanthan Gum – The significant backlogs of suppliers in China due to the crisis in the energy supply and reduced production capacity contribute to the shortage in the supply of Xanthan Gum. The supply of Xanthan Gum remains insufficient to cover the market demand resulting in gradually increasing prices.

- Dextrose Monohydrate and Maltodextrine – According to suppliers, the current supply is sufficient and the market is currently stable despite the unpredictability of currency devaluation. As of now, prices remain high due to the weakening of US Dollars against the Chinese Yuan.

- Guar Gum – The price of Guar Gum remains unpredictable and at the higher end. According to suppliers, Guar prices have risen by 15%-20% in recent weeks.