A condensed update of the current market and supply chain condition of hydrocolloids with a closer look at Carrageenan. This follows our update last January 2023.

PHILIPPINE WEATHER:

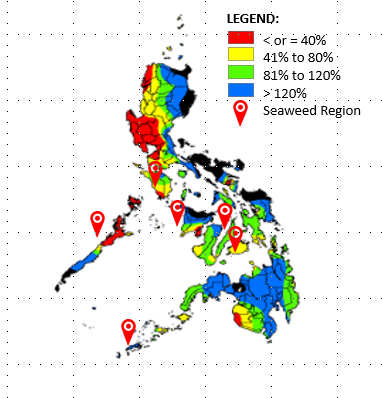

- Rainfall forecast for the month shows that most parts of the country will likely experience near to above-normal rainfall conditions except for some provinces over the western sections of northern and central Luzon that may receive below-normal rainfall. Rough seas, above-normal rainfall, and other extreme weather conditions might result in stressful abiotic conditions for seaweed farming which results in developing “ice-ice disease” in seaweed crops.

- According to Philippine Atmospheric, Geophysical, and Astronomical Services Administration (PAGASA), a tropical cyclone entered the Philippine Area of Responsibility (PAR) last February 20, 2023. The low-pressure area was last spotted in Western Pacific and brought rain over provinces in Eastern Luzon. Seaweed farms in Bicol Region were slightly affected by rains caused by the tropical cyclone.

- The low-pressure area (LPA) dissipated last Tuesday evening, February 21, and is no longer expected to affect any part of the country, said PAGASA.

- La Niña is weakening across the tropical Pacific Ocean. Most of the climate models suggest that La Niña will persist until the end of the first quarter of 2023 and then a transition to El Niño conditions is likely to occur afterward. Better sea conditions for seaweed farming will persist during the transition to El Niño.

FEBRUARY 2023 RAINFALL FORECAST

Astronomical Administration (PAGASA)

LOGISTICS:

International:

- Talks for a new labor pact between West Coast dockworkers and their employers are stretching into the 10th month. The two sides haven’t announced major progress since they struck a tentative agreement on health benefits just three weeks after the prior contract that expired last July 1, 2022. Currently, there are no major disruptions to their operation during the negotiation. (Source: The Loadstar Logistics)

- According to Maersk, port congestion at several Mediterranean destinations including Valencia, Piraeus, Haifa, and Rijeka improved in January. In addition, there is a maximum 2-day berthing delay in Koper, Slovenia due to high yard density.

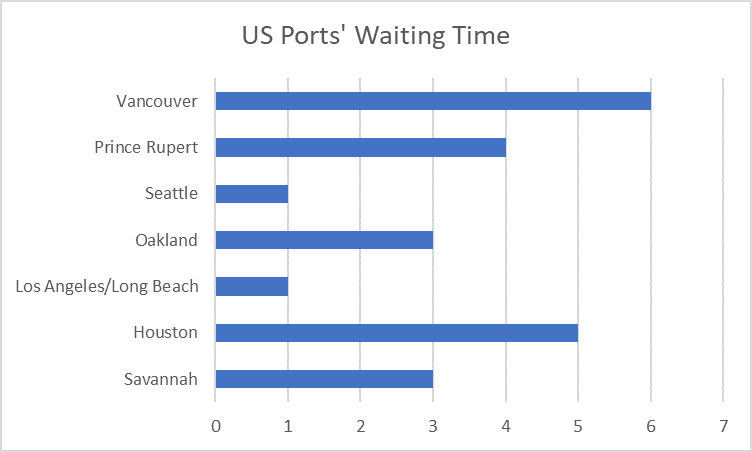

- Port spaces are generally available from Asia Pacific to North America ports. There has been a significant improvement in port congestion at Oakland with the waiting time reduced from 15 to just 3 days. Overall, USEC ports are experiencing 1-3 days waiting times. On the other hand, ports from Asia Pacific going to Latin America are currently operating normally. (Source: Maersk)

Source: Maersk

- The current operating performance at ports in Europe is stable despite the busiest port in the continent (Port of Rotterdam) seeking salary increases for their members in line with “the worsening” inflation in the Netherlands that started last December 2022. As of February 2023, a new Collective Labor Agreement (CLA) was agreed upon to result in operations at Rotterdam being back to normal. Currently, All European hubs and primary gateway terminals are currently stable. (Source: Maersk)

Local:

- According to Philippine Ports Authority (PPA), the yard utilization rate for container vans in Philippine Ports is improving. In a statement, PPA General Manager Jay Santiago said that in two international ports in Manila alone, they recorded an 80.75% yard utilization rate for the Manila International Container Terminal (MICT) and 67.80% at the Manila South Harbor. It is said that the departure of export shipments is on-time with an additional 2-3 days if delays occur.

SEAWEEDS AND CARRAGEENAN:

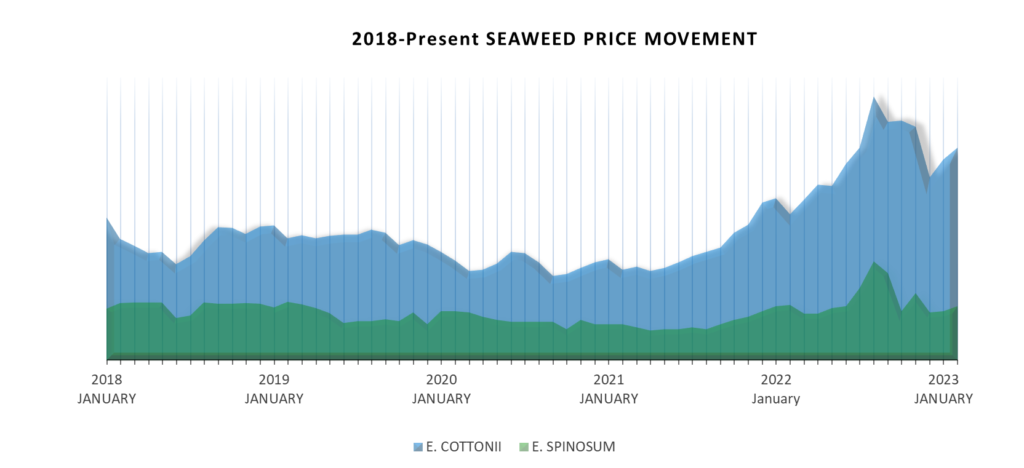

- The price of E. cottonii is currently volatile. As of now, the price is slowly moving upward with a slight increase compared to last month. In addition, most crops were harvested earlier to minimize further damage from the effect of inclement weather from last month resulting in the quality of E. cottonii remaining below par.

- The price of E. spinosum will remain stable in the next few months due to its current high supply. E. spinosum’s quality remains in an acceptable yield range and despite the extreme weather last month, the crops are unaffected due to its sturdy build.

OTHER HYDROCOLLOIDS:

- Konjac Gum – The price of Konjac Gum retains its high price due to the weakening of US Dollars against the Chinese Yuan. Severe drought also occurred in the area of China where Konjac gums are grown resulting in delayed harvest and insufficient supply.

- Locust Bean Gum – The price of LBG remains stable despite the high demand this quarter in comparison to Quarter 4 of 2022.

- Tara Gum – The price of Tara remains stable as the supply remains high from the harvest season that started last August and ended in December.

- Monoglyceride – Palm Oil (the main raw material in monoglyceride production) is forecasted to be stable this year despite volatility last year.

- Xanthan Gum – Currently, the price of Xanthan Gum is still increasing as the supply remains insufficient to cover the current market demand. The reduced production capacity and supply constraints due to China’s Energy Crisis in the past two years severely affect the current xanthan market.

- Dextrose Monohydrate and Maltodextrine – According to suppliers, the current supply is sufficient and the market is currently stable despite the unpredictability of currency devaluation. As of now, prices remain high due to the weakening of US Dollars against the Chinese Yuan.

- Guar Gum – The price of Guar Gum remains unpredictable and at the higher end. Price is forecasted to remain high in the next few months as the price from January increased by 15-20%.