A condensed update of the current market and supply chain condition of hydrocolloids with a closer look at Carrageenan. This follows our update last December 2022

PHILIPPINE WEATHER:

- Zamboanga (one of the major areas for seaweed farming), was severely affected by inclement weather last January 1, 2023, as a localized thunderstorm hit the area. At least 10 houses were destroyed by the heavy downpour where residents’ livelihoods mostly rely on fishing and seaweed farming. Moderate to heavy rains prevailed as a new low-pressure area formed on January 11, 2023 (Source: Philippine News Agency)

- The low-pressure area that was spotted last January 11, 2023, in Eastern Mindanao moved towards the Eastern Visayas area. This brought moderate to heavy with at times intense rains over Eastern Visayas, Central Visayas, Zamboanga Peninsula, Northern Mindanao, and Negros Occidental.

- According to Zamboanga City Agriculturist, Carmencita Sanchez, the city’s 1,873 seaweed growers lost Php 24.2 million after a total of 1,441.4 hectares of seaweed farms were wiped out since January 1. (Source: Philippine News Inquirer)

- As of January 24, 2023, Zamboanga remains under the Monitoring of PAG-ASA and the National Disaster Risk Reduction Management Office (NDRRMO) due to general flood advisories in major areas of Visayas and Mindanao.

- Another low-pressure area was seen inside the Philippine Area of Responsibility (PAR) and will affect PAR from January 23 to January 29, 2022, and is most likely to traverse the Northern Mindanao (CARAGA Administrative Region) and Visayas Area. Areas with seaweed farms that are most likely to be affected are Bohol, Cebu, Panay, Zamboanga, and some areas of Palawan.

- La Niña is weakening and is expected to persist until February 2023. Afterwards, El Niño (The Philippine local climate that is drier than normal weather conditions) will presume and bring better weather conditions for seaweed farming.

JANUARY 2023 RAINFALL FORECAST

Astronomical Administration (PAGASA)

LOGISTICS:

International:

- Rates for shipping containers from east Asia and China to the US were largely stable this week, an indication that ocean demand is in the process of normalizing from the sustained surge experienced over the past two years. According to online freight shipping marketplace and platform provider Freightos, the normalization of import volumes and the related easing of congested US ports are the major contributors to the steady container rates.

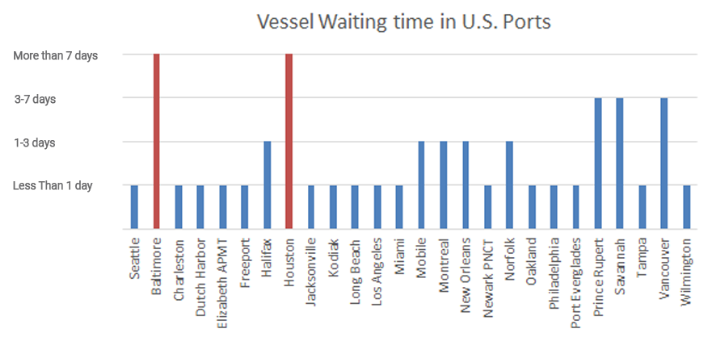

- Empty container volumes remain healthy within the US and Canada. There is less congestion within the rail and truck networks, which is helping with positioning empties as needed. Maersk seeing less congestion within depots and terminals and reduced waiting time across North America with many terminals at zero days waiting time. W Hydroclloids, Inc. currently utilizes the following US ports: Los Angeles, Norfolk, Charleston, Houston, Ohio, Oakland, and New York.

Source: Maersk

- According to a source in Philippine ports, Manila port is currently stable with on-time ship departure for exports and having 1-2 days late departure if delays occurred.

- As of January 18, 2023, workers in the UK represented by the Associated Society of Locomotive Engineers and Firemen (ASLEF) and RMT union announced that they will take part to stage fresh strikes on 1 and 3 February in the long-running dispute over jobs, pay, and conditions. The strikes are expected to halt most train services across 14 train operating companies, including intercity and commuter routes. The movement of the UK’s supply chain will be negatively affected by the said strike.

Local:

- As per seaweed buying stations, local maritime traffic will remain affected by extreme weather caused by La Niña, especially in the area of major Visayas and Northern Mindanao, resulting in delays in local shipment due to the cancellation of small ship departures.

SEAWEEDS AND CARRAGEENAN:

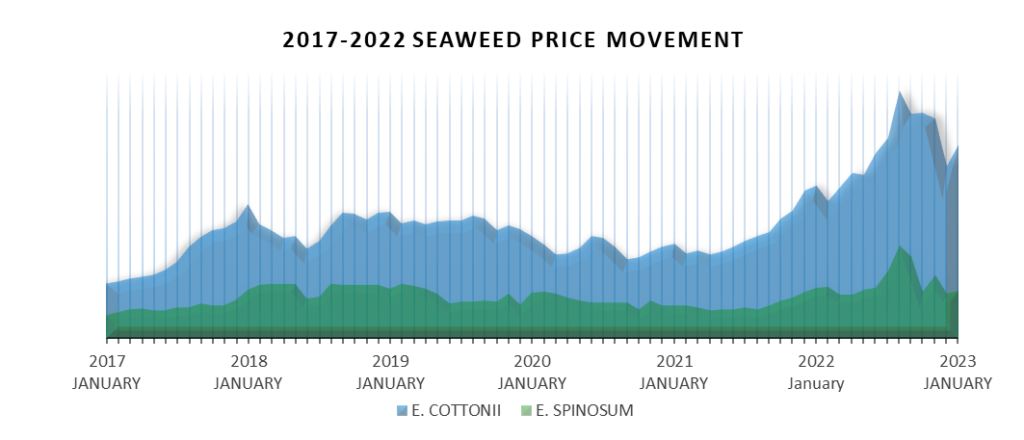

- The average price of E. cottonii may have softened in the last months of the year 2022 but as forecasted, the price will increase in the next few months due to the seaweed price increase in Indonesia and the inclement weather brought by La Niña that affects most of the supply of Philippine seaweed farms.

- In addition, the quality of E. cottonii remains low with a slight improvement. The yield of E. cottonii from the December production increased by 1%. However, the crops planted in the latest months are affected by seaweed disease (ice ice disease), and the current weather system of the Philippines will severely affect the seaweed quality in the next months.

- The price of E. spinosum will remain stable in the next few months due to its current high supply.

OTHER HYDROCOLLOIDS:

- Konjac Gum – despite the softening of the price last November, the price increased again due to the weakening of US Dollars against the Chinese Yuan. Severe drought also occurred in the area of China where Konjac gums are grown resulting in delayed harvest and insufficient supply.

- Locust Bean Gum – the price of LBG from October 2022 compared to January 2023 has declined and demand has greatly increased compared to Quarter 4 of 2022. Regardless of the increasing demand, the price of raw materials will remain stable in the next few months.

- Tara Gum – Tara price remains stable and is currently in a downtrend as the supply remains high from the harvest season that started last August and ends in December.

- Monoglyceride – Palm Oil (the main raw material in monoglyceride production) is forecasted to be stable this year despite volatility last year.

- Xanthan Gum – Currently, the price of xanthan gum is still increasing as the supply remains insufficient to cover the current market demand. The reduced production capacity and supply constraints due to China’s Energy Crisis in the past two years severely affect the current xanthan market.

- Dextrose Monohydrate and Maltodextrine – According to suppliers, the current supply is sufficient and the market is currently stable due to COVID restrictions in China resulting in low demand last Quarter 4 of 2022. Currency devaluation also affects the current price of Dextrose Monohydrate and Maltodextrine market.

- Guar Gum – The price of guar gum has risen by 15-20% in recent weeks and the market remains unpredictable. Price is forecasted to remain high in the next few months as the price from mid-November has increased by more than 40%-60%.