A condensed update of the current market and supply chain condition of hydrocolloids with a closer look at Carrageenan. This follows our update last February 2023.

PHILIPPINE WEATHER:

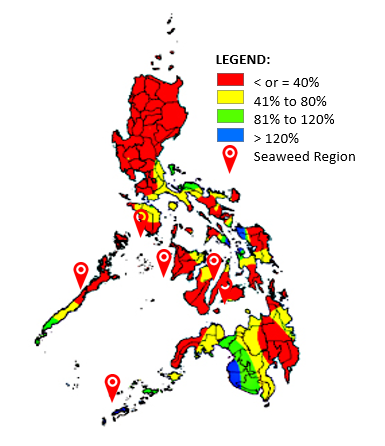

- Cloudy skies with scattered rain showers and thunderstorms were mostly felt over Eastern Visayas and Mindanao, while cloudy skies with light rains were observed over Northern Luzon. Partly cloudy to cloudy skies with light rains were experienced over the rest of Luzon and the remaining parts of Visayas.

- Generally warm and fair weather conditions will be experienced over the entire archipelago. Slight to moderate seas are experienced almost over the entire Philippines. Rough seas, above-normal rainfall, and other extreme weather conditions might result in stressful abiotic conditions for seaweed farming which results in developing “ice-ice disease” in seaweed crops.

- A low-pressure area entered the southern part of the Philippine Area of Responsibility last March 27. The low-pressure area will mostly affect parts of the Davao Region, Central Mindanao, and Southwestern Mindanao resulting in scattered rain showers and thunderstorms. Seaweed areas in nearby cities/provinces of Zamboanga and Cotabato will be slightly affected until the end of March 2023.

- Although La Niña has already ended, its repercussions may still influence the probability of above-normal rainfall conditions. The transition from La Niña to El Niño started in February will last up until April. It is said that the summer season will occur and persist from April to June. Better weather conditions for seaweed farming will prevail during the transition from La Niña to El Niño.

MARCH 2023 RAINFALL FORECAST

Astronomical Administration (PAGASA)

LOGISTICS:

International:

- Major economies, including Europe and the US, continue to report positive signs, with Asia-Pacific leading all regions in growth. In addition, as Mainland China continues to reopen, the market volume is expected to recover and grow. According to Maersk, ports in Asia and Europe are monitored to be continuously easing. US ports, on the other hand, were reported to be congested but with slow improvement.

- According to Maersk, ports from Asia Pacific – North Europe, Asia Pacific – Latin America, Asia Pacific – West Central Asia, Asia Pacific – Oceania, and Intra-Asia are operating normally with no interruptions.

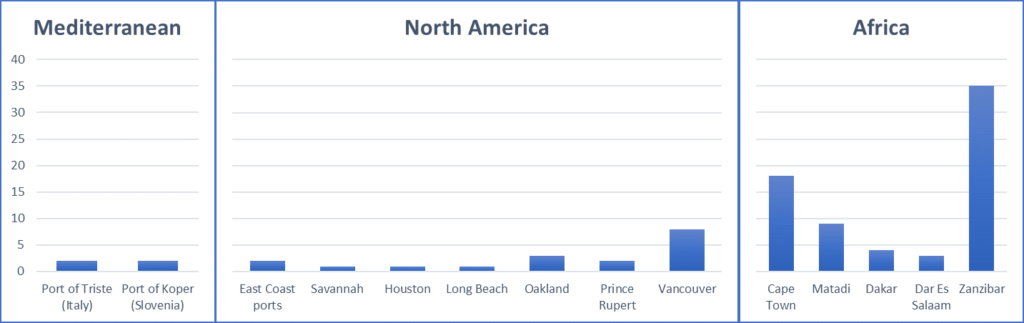

- On the other hand, the ports listed below are experiencing longer waiting times ranging from 1 to 10 days delays in the major ports in the Mediterranean and North America and 5-35 days in major ports of Africa.

Source: Maersk

- Ocean service levels for transit times have improved dramatically as the slower demand has allowed carriers and ports to catch up from previous congestion issues, according to analysts at FreightWaves. Ocean freight rates are expected to remain subdued until the peak demand during the months from September to December.

- According to FreightWaves, container shipping rates are not yet back to normal. The trans-Atlantic market has remained high, however, Trans-Pacific rates are starting to return to pre-COVID levels.

- Spot container rates from Europe to the U.S. — while falling — are still more than twice pre-pandemic rates. U.S. imports from Europe remain strong, with building materials supporting volumes.

Local:

- According to Maersk, Reefer utilization across all the Philippine terminals, especially Manila and Subic – are at manageable levels and there is no restriction or cap to acceptance since the end of February 2023. There is no waiting time in all Philippine terminals, especially in Manila. On-window is berthing on arrival while off-window vessels may be accommodated within 0.5 days of arrival.

SEAWEEDS AND CARRAGEENAN:

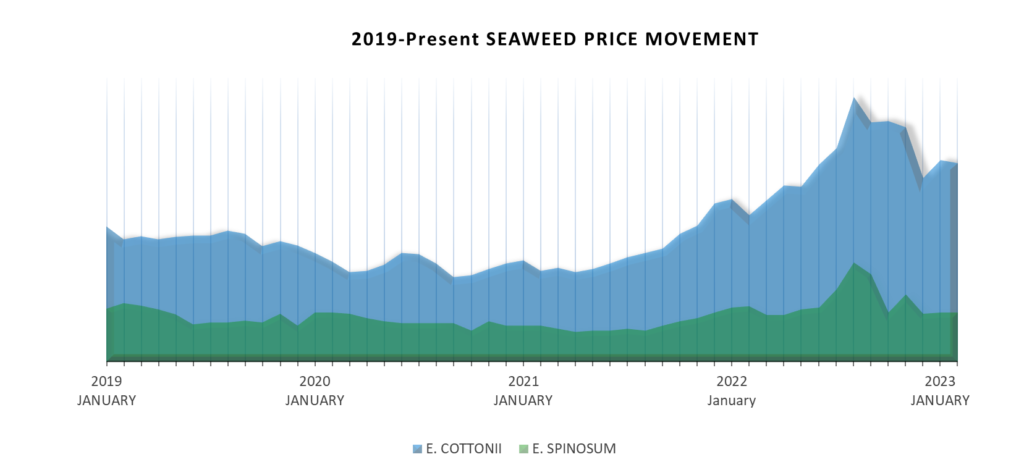

- Currently, the supply and demand of E. cottonii became stable in comparison to its condition in the last few months. In addition, the quality of E. cottonii improved as the weather conditions in the country improved giving the seaweed farmers a chance to properly dry their harvested crops. The production yield of the current supply of E. cottonii slightly increases by around 3% – 5%.

- There is no major movement in the current market of E. spinosum. The price, supply and demand, and quality/yield of E. spinosum are currently stable and are forecasted to be stable in the next few months.

- The MT Princess Empress sank off Naujan town, Oriental Mindoro, on February 28. It was carrying a cargo of 800,000 liters of industrial fuel oil. The oil spill was reported to be a threat to the seaweed industry of Western Visayas alone, especially in the provinces of Palawan and Antique. Recent reports from Philippine News Agency showed that the spill has already reached the borders of Palawan which prompted the national government to impose a ban on sailing in the affected areas, causing disruptions in seaweed farming.

OTHER HYDROCOLLOIDS:

- Konjac Gum – The price of Konjac Gum retains its high price due to the weakening of US Dollars against the Chinese Yuan. Severe drought also occurred in the area of China where Konjac Gums are grown resulting in delayed harvest and insufficient supply.

- Locust Bean Gum – The price of LBG declined in the last few months and is forecasted to remain stable in the next months.

- Tara Gum – The price of Tara remains stable as the supply remains high from the harvest season that started last August and ended in December. In addition, the price of Tara is highly correlated to the price of LBG.

- Monoglyceride – Palm Oil (the main raw material in monoglyceride production) is forecasted to be stable this year despite volatility last year.

- Xanthan Gum – The significant backlogs of suppliers in China due to the crisis in the energy supply and reduced production capacity contribute to the shortage in the supply of Xanthan Gum. The supply of Xanthan Gum remains insufficient to cover the market demand resulting in gradually increasing prices.

- Dextrose Monohydrate and Maltodextrine – According to suppliers, the current supply is sufficient and the market is currently stable despite the unpredictability of currency devaluation. As of now, prices remain high due to the weakening of US Dollars against the Chinese Yuan.

- Guar Gum – The price of Guar Gum remains unpredictable and at the higher end. According to suppliers, Guar prices have risen by 15%-20% in recent weeks.