A condensed update of the current market and supply chain condition of hydrocolloids with a closer look at Carrageenan. This follows our update last August 2023.

PHILIPPINE WEATHER:

- Earlier this month, the Philippine weather bureau PAGASA (2023) reported that a Low-Pressure Area turned tropical cyclone and called it TC ”Ineng” (local name) or internationally known as TC Yun-Yeung. It did not entirely affect the country but still enhanced the Southwest Monsoon. It still brought gusty conditions to some areas without any wind signal, particularly in coastal and upland/mountainous areas exposed to winds (alongside Tropical Storm Haikui, which strengthened it more). Over the western portions of Luzon, the enhanced monsoon is expected to bring occasional monsoon rains. It’s moving north-eastward or north-eastward towards the waters south of mainland Japan.

- El Niño increases the likelihood of below-normal rainfall conditions, which may cause dry spells and droughts in some areas of the country and have a negative impact on climate-sensitive sectors such as water resources, agriculture, energy, health, and public safety, among others. However, the Southwest monsoon season will be extended across the western section of the country, perhaps resulting in above-normal rainfall.

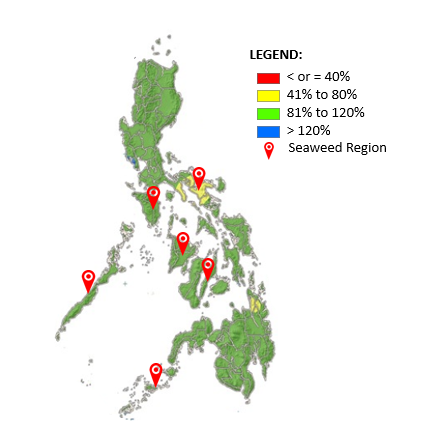

September 2023 RAINFALL FORECAST

Astronomical Administration (PAGASA)

LOGISTICS:

International:

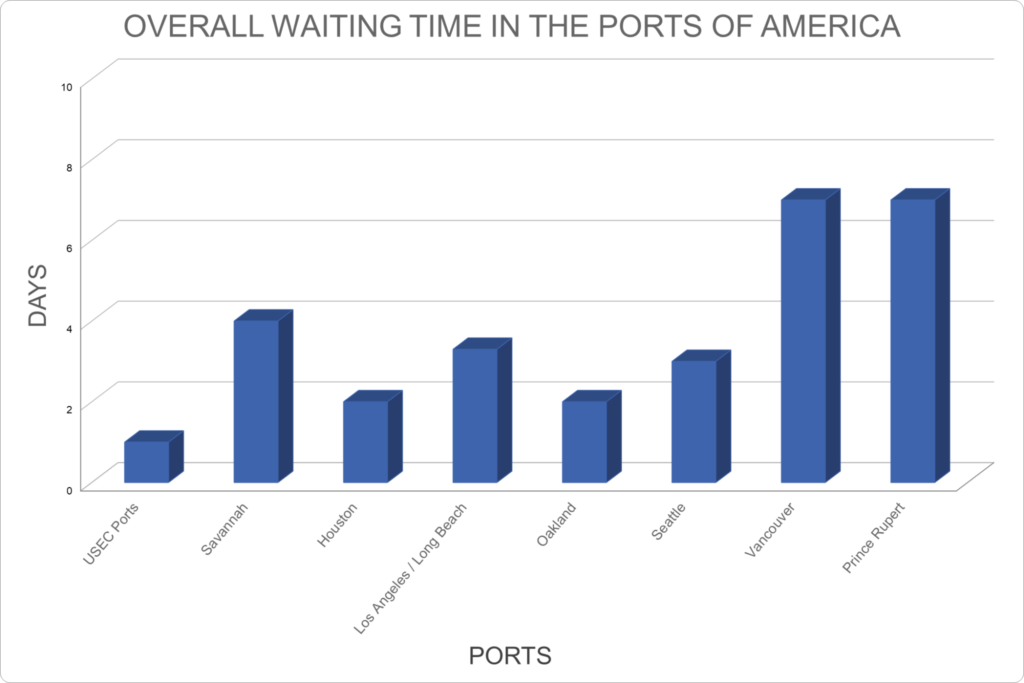

- The International Longshore and Warehouse Union (2023) said that American dockworkers had ratified a six-year deal that would have boosted wages and benefits for over 20,000 workers at 29 ports from California to Washington State (REUTERS, 2023). Longshore workers covered by the agreement are based at some of the nation’s busiest seaports, including Los Angeles/Long Beach – the most dynamic ocean trade gateway in the United States. The union and the Pacific Maritime Association (PMA) employer group reached a tentative contract deal that ended months of talks and eased worries that related West Coast port disruptions could hit the all-important retail holiday shipping season.

- According to CNBC (2023), New England and Maritime Canada experienced powerful winds, storm surge, and heavy rainfalls on Saturday (September 16, 2023) made by Hurricane Lee, the 13th named storm of 2023 Atlantic hurricane season. Some flights and cruises in the area have been affected and ended up cancelling all voyages.

- The Panama Canal is encountering lower water levels that may lead to delays and elevated expenses, so it needs to reevaluate freight routes; the Panama Canal Authority (PCA) has banned super vessel bookings until September 30 as part of its latest effort to clear a drought-related backlog. Earlier this year, PCA imposed limits on the daily transit and vessel draft restrictions, which must be maintained until next year. This restriction can alter if there is a lot of rain, although the dry season starts in late November (freightwaves, 2023).

Local:

- Regarding sea conditions earlier this month, PAGASA (2023) said that INENG brought rough sea conditions to most of the country’s seaboard. However, because of its effects, a windstorm warning is in place for the seaboards of Luzon, and the west shoreline of Visayas. Marine travel was suspended because of the hazardous sea conditions affecting passengers and transporting goods within the affected regions.

- The Department of Transportation will finalize the Philippine Ports Authority’s policy on the container registry and monitoring this month. Transport Secretary Jaime Bautista revealed this information during a recent Senate Committee on Finance hearing on the DOTr’s proposed 2024 budget. “It’s still being researched but ARTA has already reported that it may not be the best solution to the problem,” Bautista added. The Anti-Red Tape Authority encouraged PPA to examine “cost-effective alternatives” to the Trusted Operator Program-Container Registry Monitoring System (TOP-CRMS) to ease potential congestion without burdening stakeholders.

- To maintain ongoing and uninterrupted cargo-handling operations, the Philippine Ports Authority (PPA) established a special takeover (STU) at Nasugbu Port in Batangas, managed, supervised, and controlled by the PPA port manager (Portcalls, 2023). According to PPA, the average annual cargo volume at Nasugbu port is around 20,000 metric tons, and by 2024, that amount is expected to rise to 31,135 mt. Between 2022 and 2024, passenger traffic is expected to rise 2.5% annually, reaching 62,135 people. The administration and operation of ports will be transferred to the new operator that won the open bidding when the STU is no longer required.

SEAWEEDS AND CARRAGEENAN:

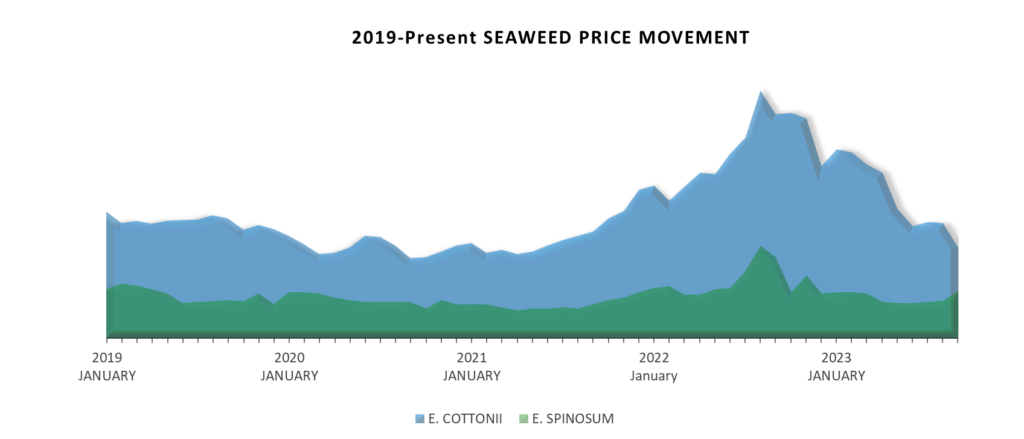

- The E. cottonii market displays a slight price decrease compared to the previous month because of the higher supply volume and lower market demand. Another factor affecting prices for E. cottonii is seaweed disease since it impacts overall quality.

- The cost of E. spinosum continues to rise as the market’s demand grows in relation to supply. Supply issues are expected to be interim since harvests are usually higher in December for E. spinosum.

OTHER HYDROCOLLOIDS:

- Konjac Gum–Because of the slow movement of the worldwide market, the price of Konjac Gum continues to lower down. The Chinese Yuan’s devaluation against the US dollar impacts market activity, particularly in pricing.

- Locust Bean Gum– The cost of LBG has decreased despite this month’s harvest season. This price drop is because of the inactivity of the global market and less demand amidst the abundant supply.

- Tara Gum– The value of Tara Gum has declined, which is caused by the strengthening of the US Dollar. The supplies remain abundant, but if the current market movement continues, we can expect a downward trend in the prices.

- Monoglyceride– Because of weak market demand, raw material prices, especially Palm Oil in monoglyceride manufacture, have fallen unexpectedly. The devaluation pressure on the Chinese Yuan against the US dollar influences the market’s sluggish pace.

- Xanthan Gum–The cost of Xanthan Gum has been reduced because of the impact caused by the sudden slow movement of the market globally. Since there is a price fluctuation of corn and coal, this impacts the price of Xanthan Gum, knowing that they account for 70% of the production cost. The stock supplies of Xanthan Gum will suffice to cover the market demand once it picks up in the coming months.

- Dextrose Monohydrate and Maltodextrin–The small decline in Dextrose Monohydrate and Maltodextrin costs can be linked to the US Dollar’s appreciation of the Chinese Yuan. According to suppliers, they expected the prices of both products to fall steadily over time as producers boost their market supply capacity and if the Chinese Yuan continues to lose over the US Dollar.

- Guar Gum– Guar gum prices have decreased due to the market’s low demand. China’s weakening Yuan against the US dollar impacts the sluggish market.