A condensed update of the current market and supply chain condition of hydrocolloids with a closer look at Carrageenan. This follows our update last July 2023.

PHILIPPINE WEATHER:

- A low-pressure area has developed into a tropical cyclone and intensified into a tropical storm that can reach the typhoon category, enhancing the southwest monsoon, the Philippine Atmospheric, Geophysical and Astronomical Services Administration (PAGASA). The Tropical Cyclone has an international name, ”Saola”, and a local name, ”Goring”, is moving northwestward over the Philippine Sea near northern Luzon. TC ”Saola” is less likely to bring heavy rains in the northern region. Still, the weather bureau said that any westward shift in the forecast track may cause heavy rainfall over the Cagayan Valley and nearby provinces. As the southwest monsoon intensifies, it also triggers occasional rainfall over Luzon’s western portions and gusty conditions over most of southern Luzon, and parts of Visayas and Mindanao.

- A Coastal Gale Warning is in force for the coastal seas of Batanes, Babuyan, and the northern shore of mainland Cagayan, owing to strong winds related to TC Saola. This may not have a significant impact on seaweed farms because the tropical cyclone is located in the north, with only modest rain falling in the southern regions.

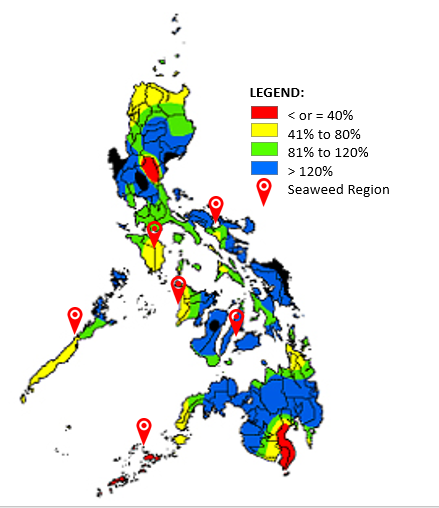

- El Niño remains present and raises the likelihood of below-normal rainfall conditions, which might have negative consequences such as dry spells and droughts in various areas of the country,” according to PAG-ASA. El Niño’s widespread effects, shown by drier and warmer-than-usual weather, will be felt in October when the influence of the Southwest Monsoon decreases.

- According to PAGASA, 26 locations (25 in Luzon and one in Visayas) could have a dry spell by the end of 2023, while 40 provinces (14 in Luzon, 13 in Visayas, and 13 in Mindanao) could experience dry conditions. A dry period is defined as three months of below-normal rainfall or two months of “way below-normal” rainfall, whereas a dry state is defined as two months of “below-normal” rain.

August 2023 RAINFALL FORECAST

Astronomical Administration (PAGASA)

LOGISTICS:

International:

- The Port of Vancouver released an operational update on August 5, 2023, regarding last July’s port strikes. The statement says that the International Longshore and Warehouse Union (ILWU) Canada ratified the tentative agreement with BCMEA, and 74.66% of the union members voted favorably. This 4-year agreement will be in effect until 2027, ending weeks of the labor dispute that started last July 1, 2023, which involved over 7,000 dockworkers belonging to ILWU Canada after the union disagreed with the British Columbia Maritime Employers Association (BCMEA) over the issues of port automation, outside contracting and the increasing cost of living. (aircargonews.net)

- In the first half of the year, total cargo throughput in Rotterdam was 5.5% lower (220.7 million tonnes) than in the same period in 2022 (233.5 million tonnes). The decrease was most noticeable in coal throughput, containers, and other dry bulk (commodities). Throughput increased in the agribulk, iron ore & scrap, and LNG industries. The port of Rotterdam anticipates a modest drop in throughput volumes for the year due to the uncertainties posed by the current geopolitical environment and rising inflation. Global trade volumes and industrial production are being weighed down by the Dutch economy’s slow development and recessions elsewhere.

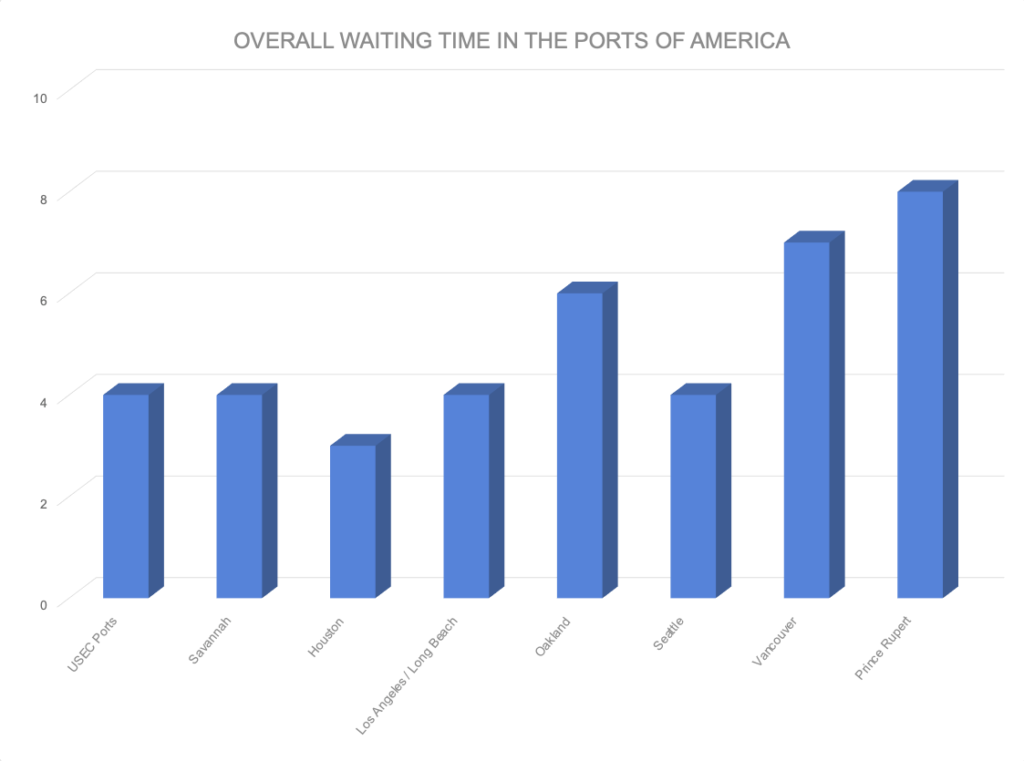

- The port strike that happened in Canada has disrupted supply systems in North America, causing difficulties at the Ports of Vancouver and Prince Rupert. Both ports are experiencing congestion and lengthier berthing window wait times, which are causing booking delays and cargo rollover on specific Trans-Pacific lines. Waiting times in major ports of America are as follows: (Source: Sunset Trans)

- To offset the negative consequences of the extended dry season, the Panama Canal Authority has increased the draft for vessels passing through the Neopanamax Locks to 44 feet. The canal, which connects the Atlantic and Pacific Oceans, is famous for saving ships’ time and money by providing a shortcut around the tip of South America. However, the Panama Canal system depends on lakes whose levels are now “close to the minimum,” according to Boris Moreno, the canal’s vice president of operations.

- As a result, everyday operations in the canal have been affected, with the number of vessels going through each day decreasing from 36 to 32. As a result, there have been delays and traffic congestion at sea.

Local:

- Senator Grace Poe has called for its abolition following the Anti-Red Tape Authority’s (ARTA) re-evaluation of the Philippine Port Authority’s Trusted Operator Program-Container Registry and Monitoring System (TOP-CRMS). According to Poe, they found the new container monitoring system unnecessary and labeled it a “cost and burden.” During the Senate hearing, they discovered that the new monitoring system will only add a layer of bureaucracy when shipping lines already have their own. ARTA said there is no port congestion, a problem the new system is designed to tackle. “While the TOP-CRMS is a preventive measure for future congestion, the cost of the project implementation should be carefully considered by PPA. They carried out the re-evaluation in response to various business groups’ demands, who complained that the new approach would raise importation costs.

SEAWEEDS AND CARRAGEENAN:

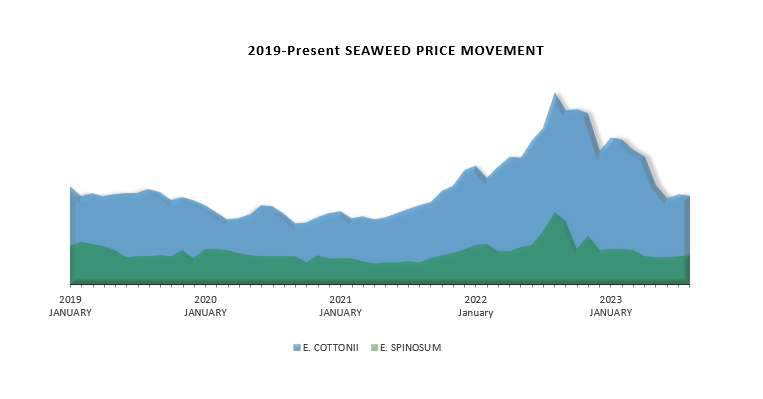

- Currently, the E. cottonii market displays a slight decrease in price because of the current high volume of supply and low market demand. The quality and supply of E. cottonii remains stable.

- The cost of E. spinosum is gradually rising because of the market’s increasing demand and low supplies. This pricing trend will continue in the following months until supplies are sufficient to meet the market’s increasing demand. The supply deficit is due to plant crops being afflicted by seaweed disease (ice ice disease) and the present weather system, which has severely impacted seaweed quality, causing some production delays and low harvest output.

OTHER HYDROCOLLOIDS:

- Konjac Gum –The price of Konjac Gum is slowly decreasing as the US dollar strengthens against the Chinese Yuan. Despite this, the severe weather conditions in China, where Konjac gums are grown, still affect the supply, resulting in a delayed harvest and sudden price changes.

- Locust Bean Gum –The cost of LBG is currently stable since the on-hand LBG supply of kibblers and stockers remains firm. The price is forecasted to remain stable in the next few months as the harvesting season will start from July to September.

- Tara Gum –The cost of Tara remains stable as the supply remains high from the harvest season that began last year in August and ended in December. In addition, it highly correlated the price of Tara to the price of LBG.

- Monoglyceride – Palm Oil (the primary raw material in monoglyceride production) is forecasted to be stable, resulting in the price of monoglyceride remaining stable this year despite volatility last year.

- Xanthan Gum – The demand for Xanthan Gum remains high in the current quarter of 2023 despite the short supply in the market driving the price to increase. The price fluctuations of corn and coal also impact the price, knowing that they account for 70% of the production cost of Xanthan Gum.

- Dextrose Monohydrate and Maltodextrin – The slight decrease in the prices of Dextrose Monohydrate and Maltodextrin can be attributed to the appreciation of US Dollar against the Chinese Yuan. According to suppliers, it is forecasted that the price of dextrose will gradually decrease over time as the producers increase their supply capacity in the market, while maltodextrin’s price is predicted to increase because of a recent explosion incident in one of the largest factories in China.

- Guar Gum – Guar Gum’s price has increased because of excessive rains in key guar-growing areas. The demand is currently stable due to the gradual decreases of demand in the Oil industry.